Introduction

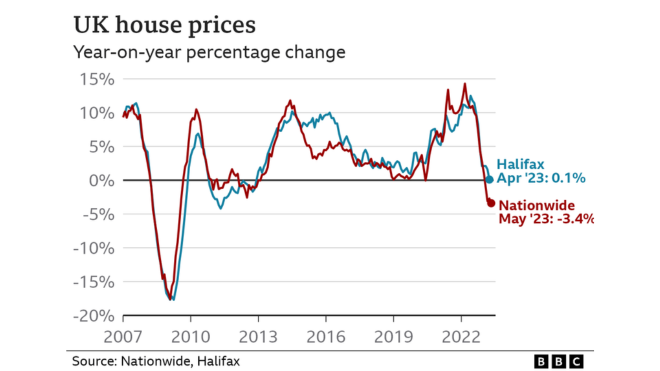

The Nationwide Building Society’s most recent figures show that UK real estate values significantly dropped in August. With a 5.3% drop compared to the same month last year. This marks the most substantial annual decrease in the housing market in over 14 years. This data suggests a noticeable shift in overall market sentiment and highlights the challenges that buyers and sellers are currently facing.

The impact of the COVID-19 pandemic

The house prices fall comes amid ongoing uncertainties in the real estate sector. The impact of the COVID-19 pandemic, combined with changing government policies and economic fluctuations. Contributed to a slowdown in the housing market. With sales completions down by around 40% in the first half of this year compared to 2021, it is evident that the market is experiencing a significant slump.

pre-pandemic levels.

UK house prices have experienced a significant fall, the largest since July 2009. This drop is attributed to high mortgage costs, which are discouraging potential buyers. The average house price is now over £14,500. Lower than in the previous year, and mortgage approvals have decreased by 20% compared to pre-pandemic levels.

In August, prices fell by 0.8%, bringing the typical UK home price to £259,153. The rise in borrowing costs in recent months has led to reduced housing market activity. Mortgage rates have increased due to 14 interest rate hikes implemented by the Bank of England since December 2021. The current rate stands at 5.25%.

Nationwide’s Report

The Nationwide Building Society, one of the UK’s top mortgage lenders, produced a survey that found a substantial fall in house prices across the country. According to their data, the average price of a UK home declined by 2.3%. In the previous year (as of the report’s publishing date). This is the most substantial drop since the aftermath of the 2008 financial crisis, pushing property values to levels not seen in over a decade.

Causes of the Decline

Several factors have contributed to this sudden downturn in the housing market:

- Economic Uncertainty: The COVID-19 pandemic’s economic fallout has many people concerned about their capacity to maintain their financial stability Therefore, prospective purchasers are being cautious and delaying their decisions to enter the real estate market.

- Healthy Nominal Income Growth: While nominal income is expected to grow healthily. It may not be sufficient to counteract the decline in housing prices.

- Modestly Lower House Prices: While house prices are expected to drop, they are not anticipated to experience a drastic decrease.

- Mortgage Rates and Bank Rates: Mortgage rates have likely peaked, but they are expected to remain relatively high. (around 5.5%-6%) until mid-2024. A potential Bank of England rate cut in mid-2024 could impact the market positively.

- Consumer Confidence: Consumer confidence remains below its long-run average, leading to widespread expectations that house prices will continue to decline.

- Further House Price Drops: Economists like Gabriella Dickens and Imogen Pattison. Predict additional drops in house prices, with Dickens estimating an 8% fall from their peak. Before demand and supply balance is restored, Pattison is forecasting an additional 7% drop on top of the existing 4% decline.

- Impact on the Building Industry: Travis Perkins, a major building materials supplier. Reported a 4.5% decrease in revenues from new-build housing and repair projects. This downturn contributed to a 31% decrease in overall adjusted operating profits to £112m.

- Weaker Consumer Confidence and Higher Interest Rates: Travis Perkins attributed its declining profits to higher interest rates and weakened consumer confidence, indicating that these factors are affecting sales negatively.

- Challenging Market Conditions: The chief executive of Travis Perkins, Nick Roberts, characterized market conditions as challenging. On the other hand, he said that he was optimistic about the long-term prospects for the company.

- Inflation and Rising Interest Rates: Inflationary pressures and the prospect of rising interest rates have made borrowing less attractive for potential homebuyers. This has further dampened demand for housing.

Implications for Homeowners and the Market

This downturn in the housing market has both short-term and long-term implications:

- Potential Buying Opportunities: For individuals who are in good financial standing, this market correction may offer a special chance to purchase real estate at a lower cost.

- Challenges for Sellers: Sellers may experience hurdles in the current market, with decreasing demand and the need to change price methods.

- Economic Stability: The state of the housing market is sometimes viewed as an indicator of the state of the economy as a whole. A protracted decline in housing prices may have larger economic repercussions for the UK.

Conclusion:

The Nationwide report highlights the challenges facing the UK housing market, characterized by the fastest house price fall in over a decade. Economic uncertainty, the conclusion of government incentives, and shifting buyer preferences have all contributed to this significant decline in house prices. It’s imperative to acknowledge that this dip is part of the natural market cycle. As the UK confronts these challenges and grapples with falling house prices, homeowners and prospective buyers should remain adaptable in these changing times.

For more Amazing and Unique information and Posts Visit our Home page... If you have any suggestions or information feel free to share with us ….